France continues to be one of the most attractive countries for foreign entrepreneurs. Insights, legal steps, and strategic guidance from Blue Bridge.

With a thriving startup ecosystem, robust legal frameworks, and an economy open to foreign investment, it offers significant opportunities for non-EU individuals looking to launch or expand a business. However, the process requires careful planning—especially regarding immigration procedures, legal structure selection, and compliance with French business regulations.

This guide will walk you through the key elements of launching a business in France, highlight available visa pathways, compare business structures, and help you avoid common mistakes.

1. Immigration Pathways for Foreign Entrepreneurs

If you’re not an EU, EEA, or Swiss citizen, you must obtain a residence permit to conduct any self-employed activity in France. The most relevant options are:

VLS-TS “Entrepreneur/Profession libérale” Visa

Ideal for those intending to operate a commercial, industrial, craft, agricultural, or liberal profession. This long-stay visa acts as a residence permit valid for one year, renewable annually. It requires you to:

- Present a financially viable business plan

- Prove income at least equivalent to the French minimum wage (SMIC, approx. €21,600/year)

- Have suitable accommodation in France

- Submit a valid business registration certificate (once established)

Passeport Talent “Créateur d’Entreprise” (now called “Project Leader” visa)

Designed for entrepreneurs with high-impact or innovative projects. This multi-year residence permit (up to 4 years) grants greater flexibility and legal advantages. Requirements include:

- A minimum investment of €30,000 in the French company

- A Master’s degree or 5+ years of relevant professional experience

- A detailed business plan with economic impact

- Sufficient financial resources for living expenses (≥ SMIC)

Talent Passport “Company Director”

For individuals managing a subsidiary of a foreign group in France. Conditions:

- Be appointed as legal representative

- Prove group affiliation

- Earn a gross annual salary ≥ 3× SMIC (approx. €64,864 in 2024)

2. Choosing the Right Legal Structure

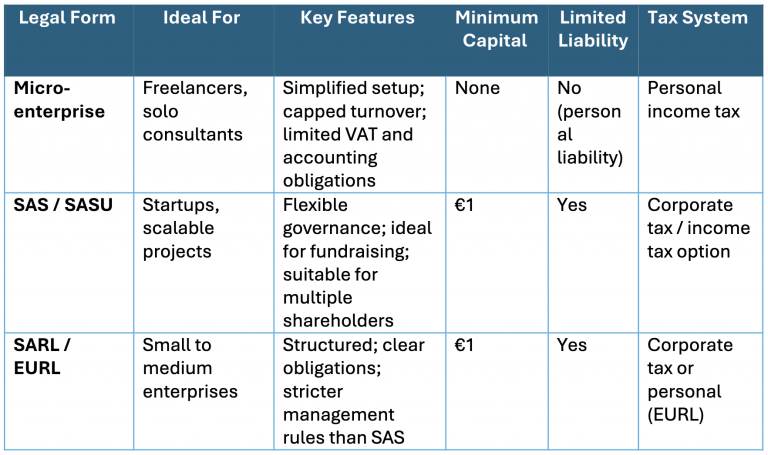

France offers multiple business structures for foreign entrepreneurs. The most common are:

SAS vs SARL – Key Considerations

- Governance: SAS (Société par Actions Simplifiée) offers more flexible management rules. SARL (Société à Responsabilité Limitée) follows stricter codes.

- Fundraising: SAS is more attractive for investors due to simplified equity issuance and share transfer.

- Solo Entrepreneurs: SASU (single-person SAS) or EURL (single-person SARL) are variations suited for one-person setups.

Blue Bridge can assist you in choosing the most efficient structure based on your long-term business strategy and tax position.

Need help? Our team at Blue Bridge offers expert advice to ensure that your application meets all legal and procedural requirements.

Book a free 20-minute consultation today!

3. Common Mistakes to Avoid

a. Choosing the wrong visa : Not all visas for self-employed individuals are suitable for all profiles. Consult an immigration lawyer to choose the right one.

b. Underestimating deadlines: Setting up a business and obtaining a visa can take 3 to 6 months, so you should plan ahead. Blue Bridge coordinates the timing of your specific process.

c. Choosing the wrong legal form: A micro-enterprise reduces the administrative burden but limits income and hiring. Understand the limits on turnover and legal liability.

d. Incomplete documentation: Omitting financial statements or diplomas can lead to rejection. Prepare your file in advance with all the necessary documents for the application.

4. Why Choose France?

France offers one of the most entrepreneur-friendly environments in the EU:

- Europe’s leading FDI destination (ahead of Germany and UK from 2020 to 2024)

- Tax incentives for R&D, green technology, and innovation

- A highly connected startup ecosystem with hubs like Station F in Paris

- Public initiatives like La French Tech, Bpifrance, and Business France offering startup grants and support

5. How Blue Bridge Supports You

At Blue Bridge, we guide foreign entrepreneurs across every stage of launching and managing a business in France:

- Visa application support: VLS-TS, Passeport Talent, Company Director

Legal structuring and registration

Business plan preparation and financial projections

Cross-border tax and compliance planning

Immigration and family reunification procedures

We coordinate with our external fiscal experts to design tax-efficient strategies tailored to your activity and jurisdiction.

Ready to Launch in France?

Let Blue Bridge help you build the foundation for your French business venture—securely and confidently. From choosing the right visa to setting up your company and optimizing compliance, our team is here for you.